Contents:

The default colors are red and green while the default period is usually 14. The ATR profit multiplier is 1 while the stoploss multiplier is 1.5. Another way of interpreting the Average True Range is to view it as the calm before the storm. This simply means that when the ATR is at a relatively low level, it means that there is not much volatility in the asset. As such, this is usually a sign that the price will have a breakout in the near term.

Moreover, an investor should also review historical readings of average true range to examine the current price movements. The value of the average true range changes and generally falls during the day. Nonetheless, it provides a satisfactory approximation of the price variations and the time that will take for the movements. The average true range is an indicator of the price volatility of assets over a specific period. A trailing stop-loss is a way to exit a trade if the asset price moves against you but also enables you to move the exit point if the price is moving in your favor. Many day traders use the ATR to figure out where to put their trailing stop-loss.

We offer one-click trading experience with 3,700+ world-renowned markets.

ATR Trailing Stops are primarily used to protect capital and lock in profits on individual trades but they can also be used, in conjunction with a trend filter, to signal entries. Finally, let’s compare a daily chart of September 2012 ICE Coffee futures to our daily E-mini S&P 500 futures chart. Remember that on the daily S&P 500 chart, low volatility was 16.50 points or $825.00 per contract.

The opinions expressed here are solely those of the author and do not reflect the opinions of CQG, Inc. or its affiliates. Once you have calculated the three true ranges, you can then move on to calculating the ATR formula. The Keltner channel is one of the most popular indicators on MetaTrader 4 , which is mostly used by forex traders because the FX market is quite volatile. It’s important for you to understand the different volatility indicators and how to use them – to help you make more informed trading decisions.

His idea was that high volatility would follow periods of low volatility. This would form the basis of an intraday trading system. A stock’s range is the difference between the high and low prices on any given day.

Using the ATR for the stop loss

This is known as a lock limit and represents the maximum change in a commodity’s price for one day. During the 1970s, as inflation reached unprecedented levels, grains, pork bellies, and other commodities frequently experienced limit moves. This will ensure that all aspects of price action, trend, and market volatility are covered for a comprehensive trading strategy. Welles Wilder in his 1978 book New Concepts In Technical Trading Systems. ATR is a measure of volatility for a stock or index and is explained in detail at Average True Range.

- Typically, the ATR calculation is based on 14 periods, which can be intraday, daily, weekly, or monthly.

- This is in stark contrast to other trend and momentum indicators such as the RSI or the STOCHASTIC indicator.

- For example, draw support and resistance levels through the flat range’s extremums and open a trade in a breakout direction.

- As a forex trader, you have only three things to figure…

- The ATR indicator meaning tells us how much the price has changed in a current period compared with previous periods.

You can multiply the current ATR reading by two and place the stop loss at this level. If you are going long, you can place the stop loss below the entry price, and if you are going short, you can place the stop loss above the entry price. If the price is moving in the direction of potential profits, the stop loss will continue moving up or down until you close the position, once the trailing stop loss level is reached.

How to Calculate ATR

First look for a weekly chart where the ATR and volatility is at multi-year lows. Next identify the range in price during this period, or the strongest support and resistance levels. Wait for price to break out from the range or from the support/resistance level and pounce on the trade. One simple method is to open a position whenever price moves more than 1 ATR from the closing price in the prior session. The ATR can be used on any time frame too, from 1 minute to 1 month, making it useful for any type of trader. Most traders agree that volatility shows clear cycles and relying on this belief, ATR can be used to set up entry signals.

We’re also a community of traders that support each other on our daily trading journey. Markets with high price fluctuation offer more risk/reward potential, because prices rise and fall in a short time, giving the trader more opportunities to buy or sell. Targeting price levels at, or close to, the ATR bands may improve target placement for trend-following traders. Another popular use case for the ATR is to look for exhausted price movements. Since the ATR tells us the average range the price has moved over a given period, we can use this information to estimate the likelihood for trends to continue or stall.

ATR-Filtered, Another New Adaptive Moving Average is a modification of @cheatcountry’s “Another New Adaptive Moving Average ” shown below I’ve added AT- stepped filtering. This is a standard ATR filter that works by requiring movement by XX multiple of ATR before registering a trend flip. Please note that this report is intended solely for educational purposes. Investing and trading involves considerable risk and losses can be substantial.

Are you sick of getting stopped out of your trades prematurely? Here’s how to fix it…

While longer timeframes will be slower and likely generate fewer trading signals, shorter timeframes will increase trading signals. For example, a shorter average, such as 2 to 10 days, is preferable to measure recent volatility . For gauging longer-term volatility, on the other hand, a 20 to 50-day moving average should be used. The Average True Range refers to a technical analysis indicator that measures the volatility of an asset’s or security’s price action.

Instead, because it has moved significantly more than the average, it is more likely to fall and stay within the established price range. Assuming a valid sell signal is triggered, traders might take a short position in this case. Although it was initially developed for commodity markets, traders now employ the ATR indicator in various financial markets, including trading stocks, cryptocurrencies, or indices. Long-term investors make most of their money when a stock is rising slowly over a long period of time.

Interpreting the ATR indicator values is simple and straightforward. The standard number to use with an ATR indicator is 14—as in 14 days—but that isn’t the only strategy that works. The Parabolic SAR, or Parabolic Stop and Reverse, is a trailing stop-based trading system and is often used as a technical indicator as well. As a technical indicator, Parabolic SAR is known as a… The Average True Range indicator identifies periods of high and low volatility in a market. Welles Wilder developed the Average True Range to create a tool to measure volatility.

Unlike oscillators, it hasn’t got the “0” and “100” limits that define overbought and oversold territories. Thus, the ATR indicator is a specific technical indicator that combines the three groups’ features. No matter the quality of the entry, profit or loss is ultimately determined when a trade is exited or closed. The ATR is efficient in determining optimal price points to place stop loss and take profit orders. The opposite could also occur if the price drops and is trading near the low of the day and the price range for the day is larger than usual.

Comparison between Average True Range (ATR), Average Day … – TradeThatSwing

Comparison between Average True Range (ATR), Average Day ….

Posted: Fri, 17 Mar 2023 07:00:00 GMT [source]

These types of atr volatility indicators are useful as traders can use the charts to identify entry and exit points for their positions. This is usually on a candlestick chart, where volatility and price gaps are easy to spot. Average True Range is a technical analysis volatility indicator originally developed by J. The indicator does not show the price trend, but simply shows the degree of price volatility. The average true range is an N-day exponential moving average of the true range values.

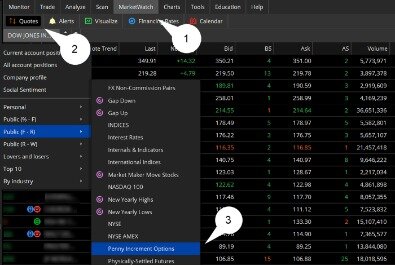

By contrast, low volatility according to the ten-day ATR in Coffee futures is 400 points, or $0.04/lb., or $1,500.00 per contract . To illustrate the point, let’s look at the CME Group September 2012 E-mini S&P 500 futures contract. Notice that based on the daily chart shown below, over the past four months, 16.50 points is considered low volatility as defined by Wilder’s ten-period ATR.

A bearish support break with an increase in ATR would show strong selling pressure and reinforce the support line break. You can also use the ATR in to place your stop loss using the same principle. As the ATR gives you a good indication of how far the price will move, you can set your stop loss accordingly.

If you want to ride massive trends in the markets, you must use a trailing stop loss on your trades. The Average True Range indicator measures the volatility of the market. A mistake traders make in how to use ATR is to assume that volatility and trend go in the same direction. AvaTrade offers comprehensive trading tools and resources that help traders get the most out of their trading activity. Bitcoin, that have higher ATR values, traders can trade them with smaller lot sizes; while assets, such as the EURCHF pair that prints lower ATR values, can be traded with larger lot sizes.

Absolute ATR

The average true range also takes into account the gaps in the movement of price. The ATR works by creating an average of the true range, which is the classic measurement of the range of movement in an asset’s price. The average true range, in contrast, is a smoothed moving average of the true range values, which seeks to make assessing an asset’s volatility easier and more accessible for traders. For example, when analysing a price chart, traders often use the ATR to determine where to place a trailing stop loss.

Trend Trading Strategy for High Momentum Stocks (with ATR-based … – TradeThatSwing

Trend Trading Strategy for High Momentum Stocks (with ATR-based ….

Posted: Wed, 24 Aug 2022 07:00:00 GMT [source]

If you multiply the average true range by 1.5 or 2, you can use that figure to set the stop-loss point around your entry price. If you’re buying, you place a stop loss at a point equivalent to twice the ATR below the entry price. If you’re shorting an asset, you place the trailing stop at a point that is twice the ATR above the entry price and continue to move it once the price reaches a particular level.

- However, the price of the stock’s already risen above the average; hence it is not advisable to assume that the price will rise further.

- To clearly map the information provided by the channel and swiftly act on any future trade indications.

- Another use case for the ATR-based Keltner channel is to estimate the likelihood of a trend continuation.

- Then switch to the one-minute time frame and find where the current H1 time frame begins.

The https://trading-market.org/ True Range is a technical indicator that measures the volatility of an asset’s price. An expanding ATR indicates increased volatility in the market, with the range of each bar getting larger. A reversal in price with an increase in ATR would indicate strength behind that move. ATR is not directional so an expanding ATR can indicate selling pressure or buying pressure.

The sequential ATR value could be estimated by multiplying the previous value of the ATR by the number of days less one and then adding the true range for the current period to the product. We offer a wide range of technical indicators that are not limited to ATR, as well as providing a range of order execution tools for fast trading, which in turn helps you to manage risk. To get the most out of this guide, it’s recommended to practice putting this ATR indicator trading strategy into action. The best risk-free way to test these strategies is with a demo account, which gives you access to our trading platform and $50,000 in virtual funds for you to practice with.

The ATR is a unique volatility indicator that reflects the degree of enthusiasm/commitment or disinterest in a move. Large or increasing ranges typically demonstrate traders are prepared to continue to bid up or sell short a stock throughout the day. Conversely, decreasing or narrow ranges suggest waning interest.